Avvio Rapido

In questa sezione vedremo la struttura della piattaforma MangoLabs e come le diverse componenti lavorano insieme.

whatLearn.title

- ▸La divisione tra Laboratorio e Simulazione (dati storici vs real-time)

- ▸Come funziona l'editor strategie visuale e i tipi di nodi disponibili

- ▸Il sistema delle Feature e come usarle nelle strategie

- ▸Il processo di Backtesting e l'analisi dei risultati

- ▸Come deployare strategie in Simulazione e monitorare l'esecuzione

Panoramica Ambienti#

MangoLabs si divide in tre ambienti con ruoli distinti nel ciclo di sviluppo delle strategie.

Laboratorio

Ambiente dove crei e testi strategie su dati storici.

Tipo di dati: Storico

Simulazione

Ambiente dove testi le strategie in condizioni di mercato reali con capitale virtuale.

Tipo di dati: Real-time

Produzione

Ambiente per il trading con capitale reale connesso a exchange.

Non disponibile al momento

Tipo di dati: Real-time

Differenza fondamentale: Il Laboratorio lavora su dati storici per validare la strategia. La Simulazione lavora su dati real-time per testare il comportamento in condizioni di mercato attuali. Una volta validata nel Lab, la strategia passa in Simulazione per verifica finale prima di considerare deployment in produzione.

Editor Strategie Visuale#

L'innovazione principale di MangoLabs è permetterti di costruire strategie di trading disegnando il ragionamento, non scrivendo codice. Trascini nodi su una canvas, li configuri e li colleghi: ogni connessione è un flusso di dati che passa da un nodo all'altro. Il sistema interpreta questo grafo ed esegue la tua logica tick-by-tick sul mercato.

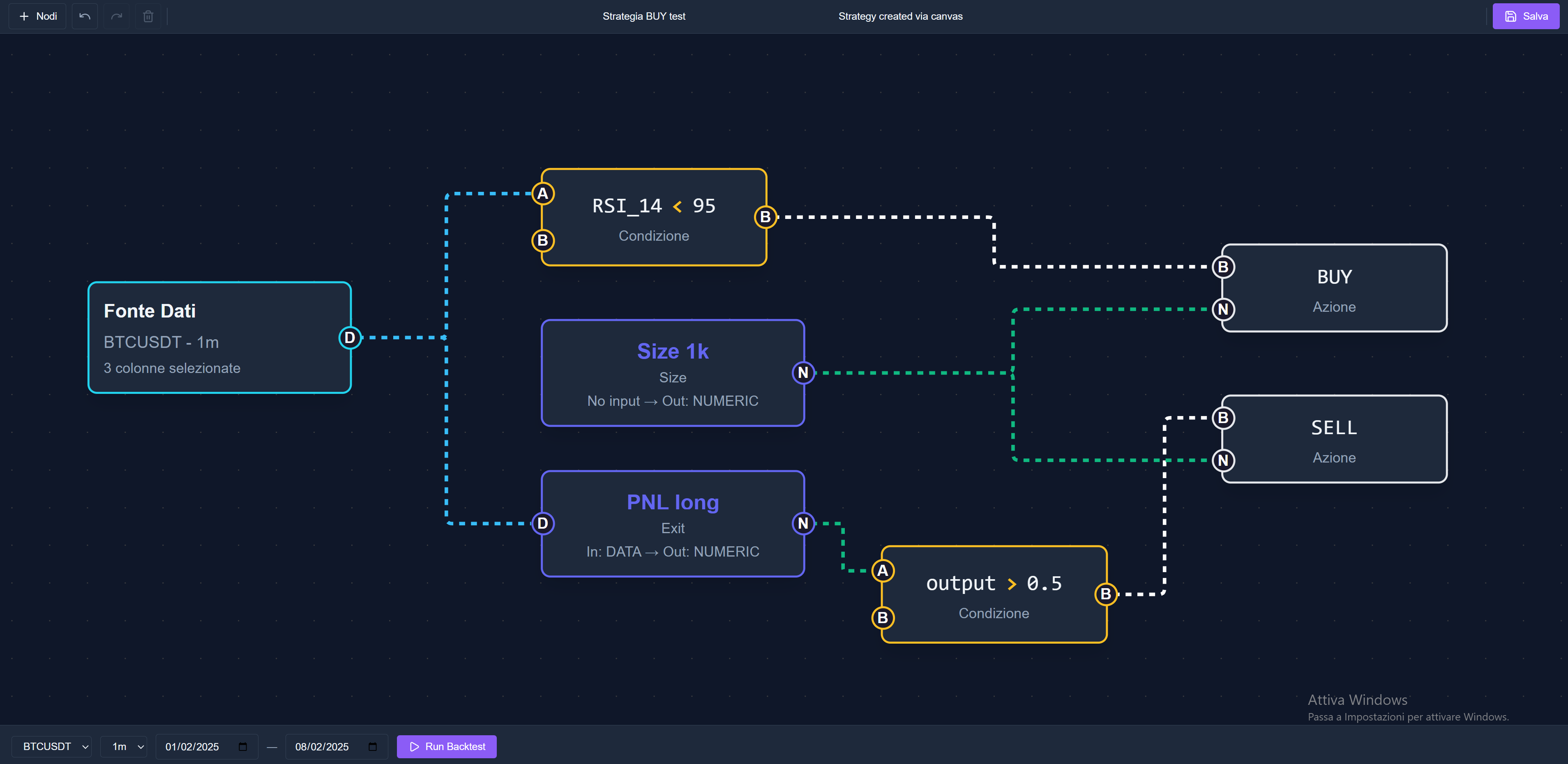

Esempio di strategia completa: dai dati di mercato all'esecuzione dell'ordine

Nodi

Blocchi che eseguono operazioni specifiche: leggere dati, calcolare, verificare condizioni, generare segnali. Hanno input e output che colleghi tra loro per costruire la logica.

Connessioni

Trasferiscono dati da un nodo all'altro. Il sistema valida la compatibilità automaticamente e determina l'ordine di esecuzione: prima i nodi che producono i dati, poi quelli che li consumano.

Come Funziona l'Esecuzione

Ad ogni candela, la strategia parte dai nodi che leggono i dati (prezzi, indicatori, feature) e segue il flusso attraverso le elaborazioni e le condizioni fino ad arrivare ai nodi che generano gli ordini di trading. L'obiettivo è determinare quali azioni eseguire: comprare, vendere o non fare nulla.

Input Dati

Elaborazione

Output Azione

Nodi Strategia

Ogni strategia si compone di 5 tipi di nodi, ognuno con una funzione specifica. Li configuri, li colleghi tra loro e costruisci la logica di trading.

Nodo necessario che fornisce i dati di mercato: prezzi OHLCV, feature tecniche, stato del portafoglio

Gestisce gli ordini di trading: BUY per comprare, SELL per vendere

Confronta due valori e restituisce vero o falso: maggiore, minore, uguale

Combina più condizioni con operazioni logiche: AND (entrambe vere), OR (almeno una vera), NOT (inverti risultato)

Componenti riutilizzabili che incapsulano logiche complesse: crei una volta, usi ovunque

Annotazioni visive sulla canvas per documentare e organizzare la strategia

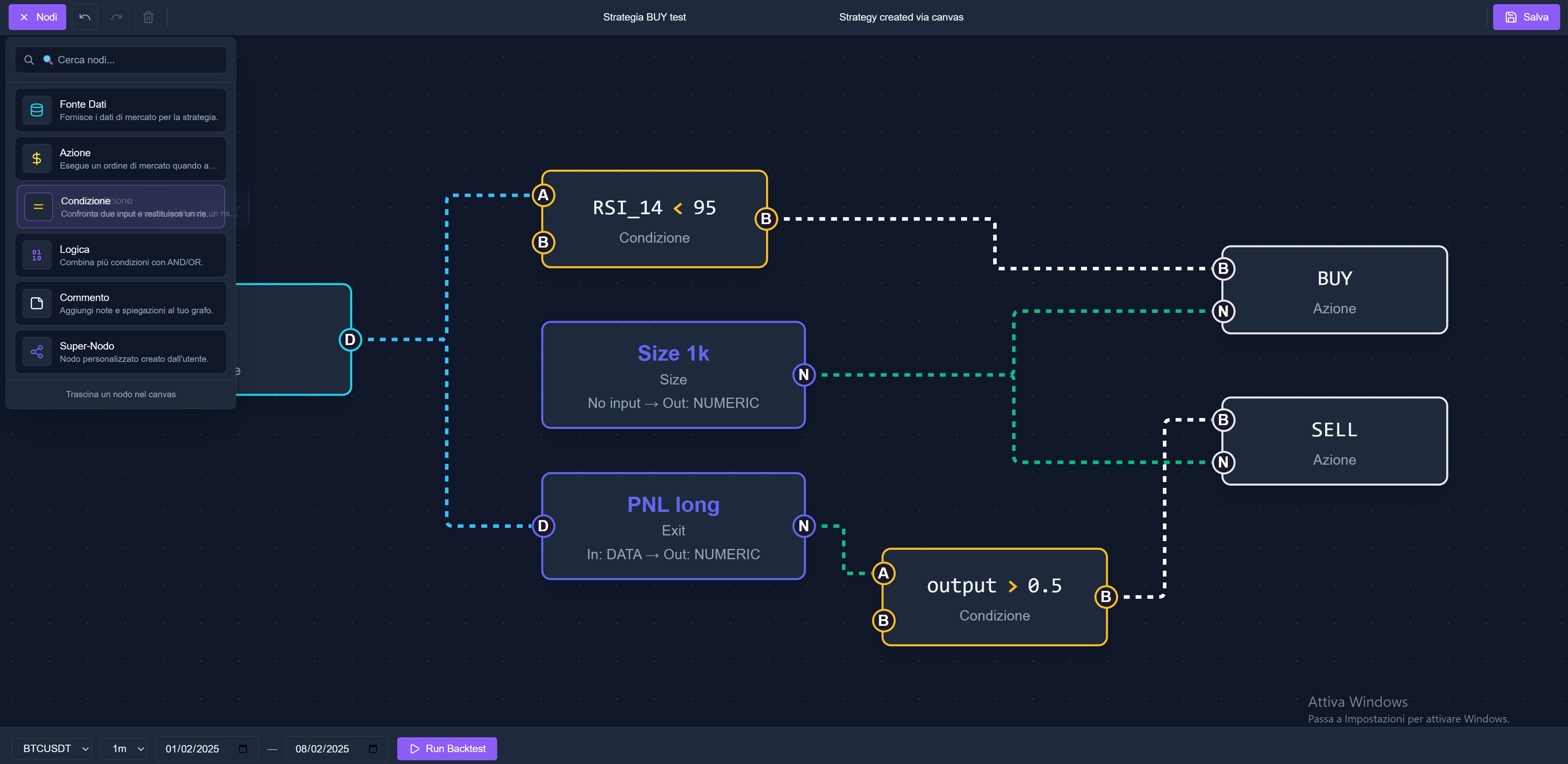

Palette dei nodi strategia: trascina i nodi sulla canvas per costruire la tua logica

Validazione Tempo Reale Il sistema valida la strategia mentre la costruisci: verifica che tutte le connessioni siano compatibili, che non ci siano cicli, che i nodi Action ricevano i dati corretti. Se c'è un errore, ricevi feedback immediato prima ancora di salvare.

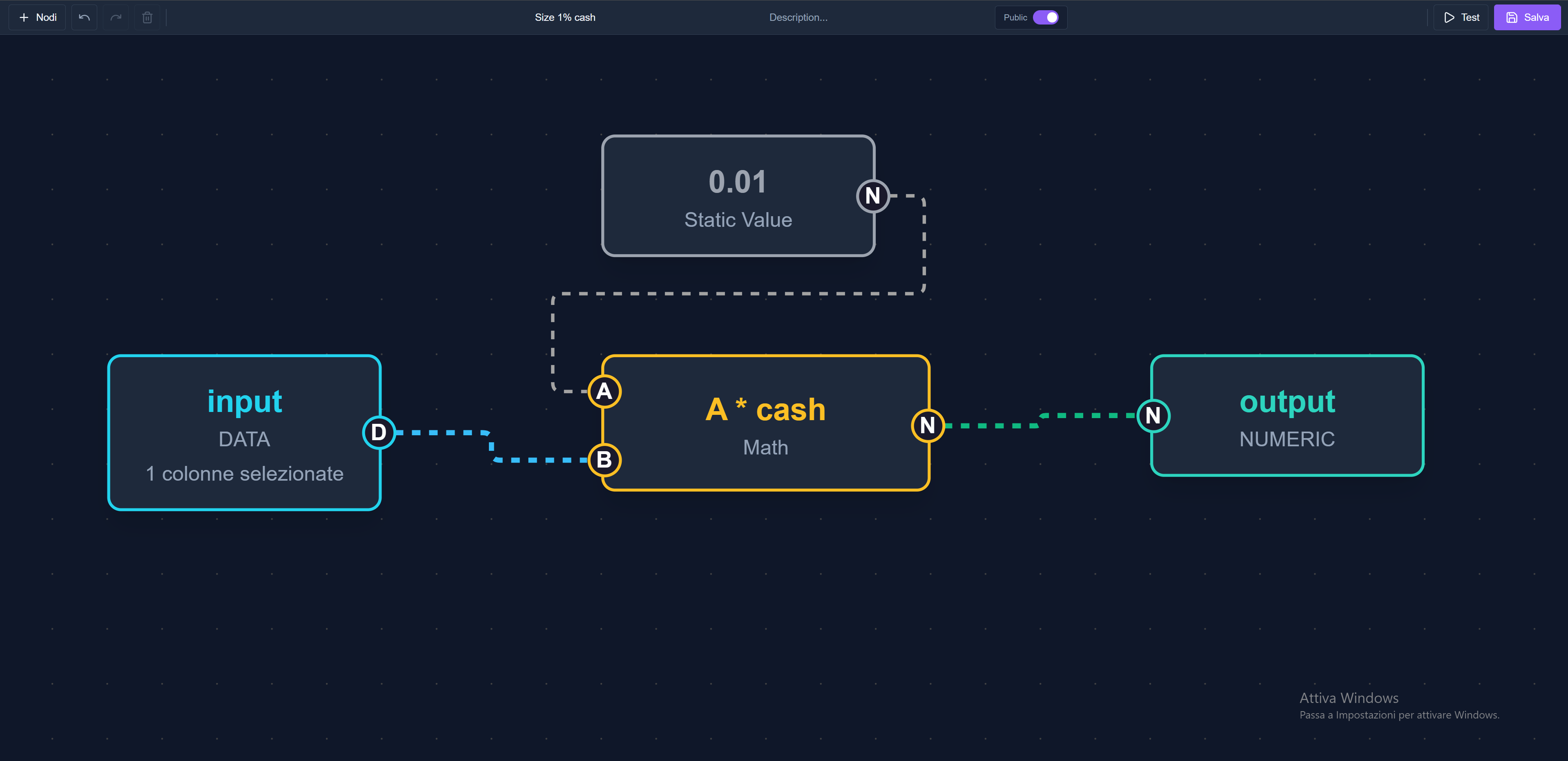

Editor Super-Nodi

I Super-Nodi sono componenti riutilizzabili che accettano input e producono sempre output.

Servono a gestire calcoli complessi da utilizzare nelle strategie: ad esempio per calcolare il size delle posizioni o costruire indicatori real-time personalizzati.

Nodi Interni ai Super-Nodi

All'interno dei Super-Nodi puoi utilizzare solo nodi specifici per elaborazioni e calcoli:

Riceve dati dalla strategia principale

Restituisce i risultati elaborati

Operazioni matematiche: somma, sottrazione, moltiplicazione, divisione

Costanti numeriche da usare nei calcoli

Riutilizzo: I Super-Nodi possono essere salvati in libreria e riutilizzati in strategie diverse, evitando di ricostruire la stessa logica più volte.

Editor Super-Nodi: costruisci calcoli complessi con nodi Input, Output, Math e Costante

Vedi in Azione

Pronto a costruire la tua prima strategia? Accedi all'editor visuale e inizia a disegnare la tua logica di trading.

Backtesting e Analisi#

Il Backtesting esegue la strategia su dati storici per valutare la sua performance prima del deployment in simulazione.

Pagina dei risultati del backtest con metriche, equity curve e registro trade

Risultati del Backtest

Una volta completato il backtest, puoi visualizzare tre elementi chiave:

- •Metriche di performance (Total Return, Sharpe Ratio, Max Drawdown, Win Rate, ecc.)

- •Equity Curve - l'evoluzione del portafoglio nel tempo

- •Registro completo dei trade eseguiti con dettagli su entry, exit e P&L

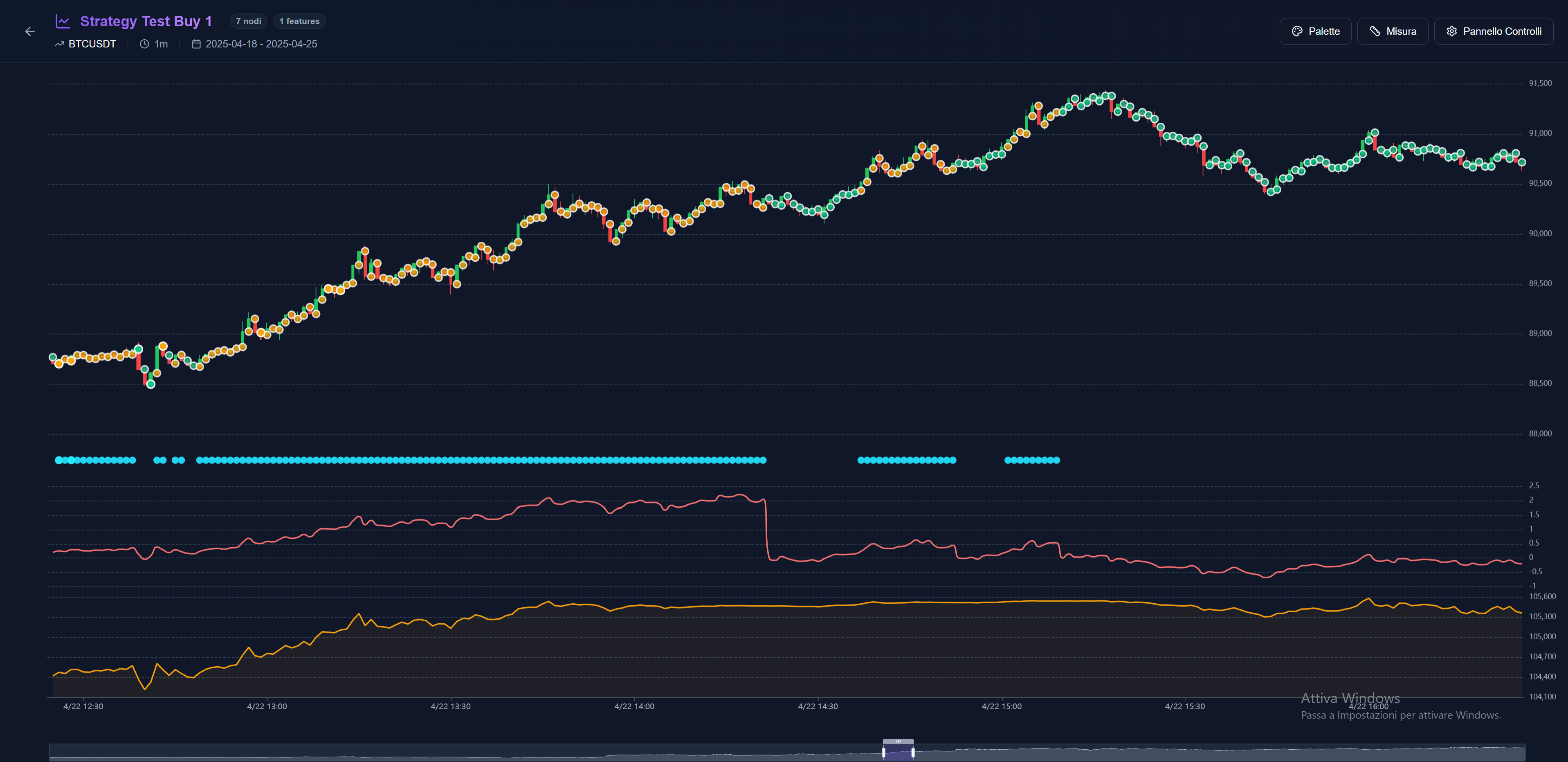

Analisi Avanzata

Oltre alle metriche standard, puoi visualizzare nel dettaglio come ha operato la strategia nodo per nodo direttamente sul grafico. Vedi le condizioni che si sono verificate, i valori calcolati dai nodi matematici e quando si sono attivati i segnali di ingresso/uscita. Questo ti permette di capire esattamente perché la strategia ha preso ogni decisione, facilitando debugging e ottimizzazione.

Visualizzazione nodo-per-nodo: vedi le logiche della strategia direttamente sul grafico

Scopo: Il backtest serve a validare la strategia prima di deployarla in Simulazione. Una strategia con metriche positive e un comportamento comprensibile può procedere ai test real-time.

Simulazione#

La Simulazione esegue strategie in tempo reale su dati di mercato live con capitale virtuale. Test finale prima di considerare deployment con denaro reale.

Gli Account Virtuali rappresentano portafogli con capitale configurabile associati a un exchange specifico. Ogni account può ospitare più Strategie Deployate simultaneamente, ciascuna con una porzione dedicata del capitale disponibile per consentire diversificazione e test paralleli. Il sistema fornisce Monitoraggio Real-Time completo: posizioni aperte, storico trade, equity curve aggiornata e metriche progressive calcolate su dati di mercato live.

Dashboard di una strategia in esecuzione: posizione corrente, equity curve live e metriche aggiornate in tempo reale